- The Death of the Dollar

- Posts

- 3 Market Moves That Shaped the Dollar This Week

3 Market Moves That Shaped the Dollar This Week

Rates, Risk, and Resistance, The Week That Was

Another week, another wobble in the world of the dollar.

What started as a calm grind lower in the DXY turned into a more chaotic ride by Thursday as bond yields whipsawed and gold took off.

Inflation signals remain sticky, Fed speakers played both sides, and the yen is back in focus.

There’s still no clear exit from the debt-fueled malaise — but markets are trying to price the path.

📊 This Week in Charts

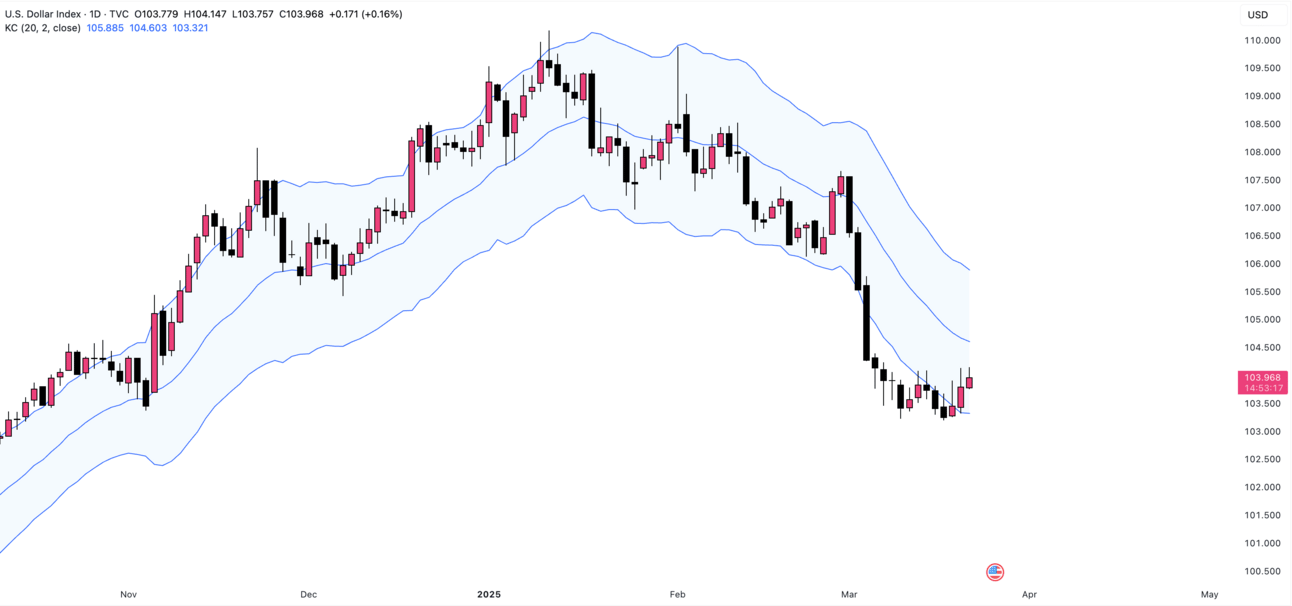

1) DXY — Slipped to 103.10 Before Bouncing

The U.S. Dollar Index (DXY) hit a two-week low midweek, touching 103.10 before stabilizing.

Traders faded soft housing and retail data, but the dollar’s decline was arrested by a surprisingly hawkish Fed tone on Thursday.

However, market conditions point to further downside or neutral at best.

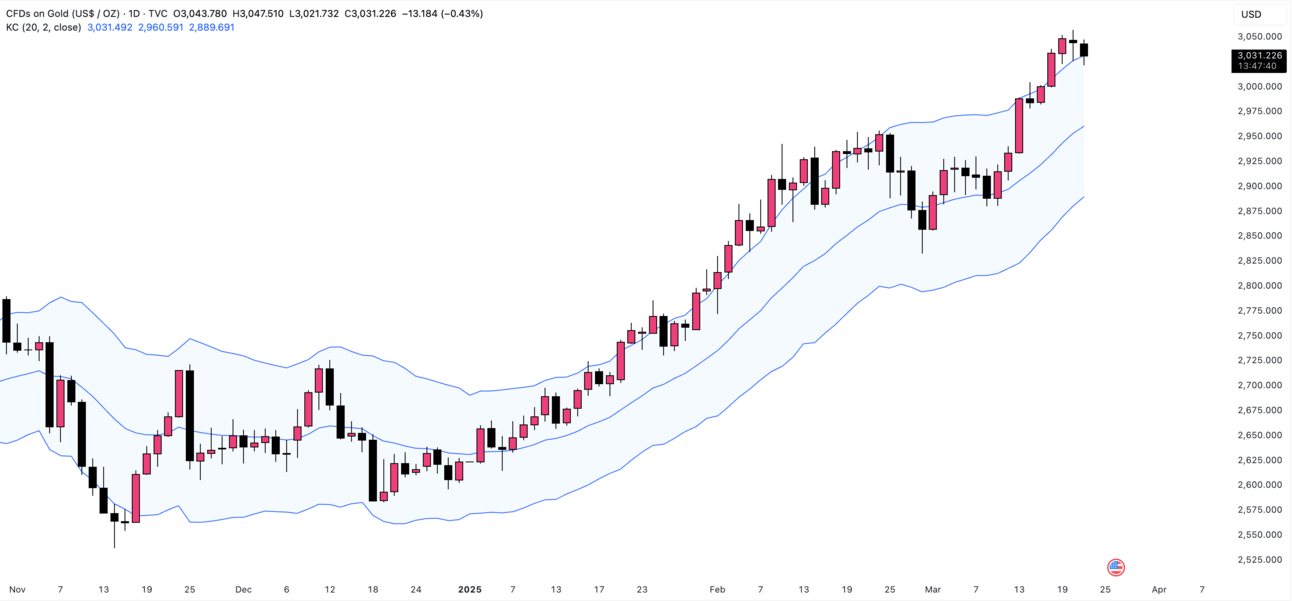

2) Gold — Surged over $3,000/oz Amid Safe Haven Bid

Gold prices surged to unprecedented levels, driven by investors seeking refuge amid escalating geopolitical tensions and economic uncertainties.

Major financial institutions have revised their forecasts, with Citi Research increasing its three-month price target to $3,200 per ounce, citing robust demand from central banks and exchange-traded funds.

The current accumulation zone sits between $2,900 - $3,000/oz.

Thinking about positioning in gold to combat global turbulence? Get a FREE Investors Kit and receive up to $15,000 in FREE Silver if you qualify. Click below to learn more.

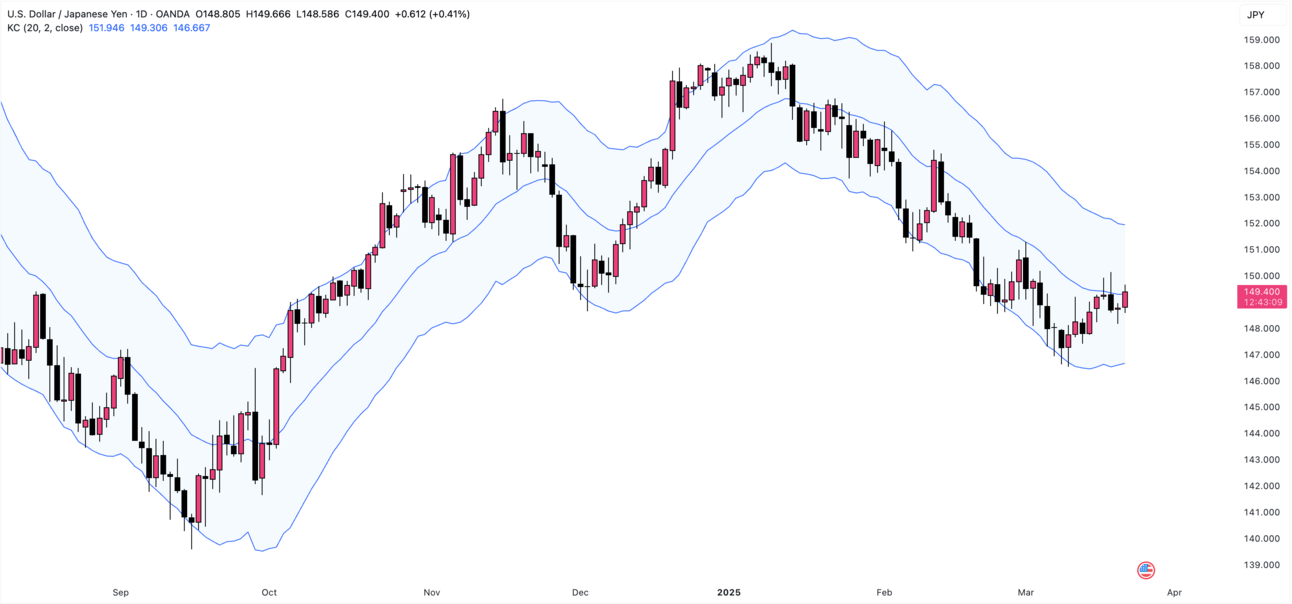

3) USD/JPY — Hovered Around 149 Amid Monetary Policy Divergence

The USD/JPY pair fluctuated near the 149 level this week, influenced by contrasting monetary policy signals from the Federal Reserve and the Bank of Japan.

The Fed's indication of maintaining current interest rates bolstered the dollar, while Japan's rising inflation rates fueled expectations of potential rate hikes by the BOJ, contributing to yen volatility.

📌 Key Events Recap

Event | What Happened |

|---|---|

CPI | Core CPI YoY came in hot last week at 3.5% vs. 3.3% est. — the market repriced fewer rate cuts. |

Fed Speeches | Bostic and Bowman pushed back on premature cuts; Powell stayed vague but leaned cautious. |

Treasury Auctions | 20-year auction saw tepid demand; yields edged higher post-settlement. |

🗣️ Data Point of the Week

“Debt-to-GDP is now 128% — and climbing.”

The CBO released updated projections showing U.S. debt could hit 137% of GDP by 2030 without major fiscal reforms. The market is increasingly eyeing this as a structural anchor on the dollar.

👀 What’s Next Week?

Monday: Light data, but markets will digest Powell’s post-FOMC tone.

Big Data: Thursday’s PCE inflation print is the main macro event; also watch global PMIs.

Ongoing themes: Dollar vs. Gold divergence, Japan intervention risk, long-term debt trajectory.